Artificial Intelligence (AI) Market by Offering (Discriminative AI, Generative AI, Hardware, Services), Technology (ML, NLP, Context-aware AI, Computer Vision), Business Function (Marketing & Sales, HR), Vertical and Region - Global Forecast to 2030

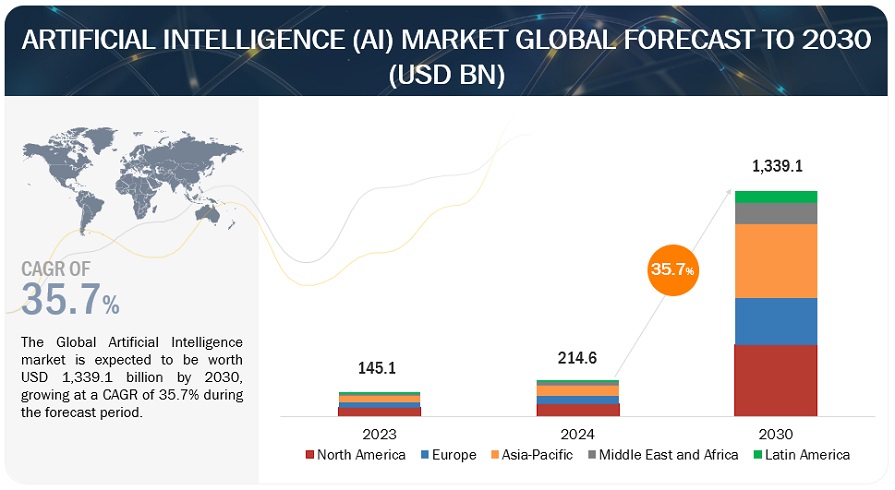

[650 Pages Report] The Artificial Intelligence (AI) market is witnessing a rapid growth trajectory, with estimates projecting a substantial market value surge from approximately USD 214.6 billion in 2024 to USD 1,339.1 billion by 2030. This phenomenal upward trend, characterized by a remarkable CAGR of 35.7% between 2024–2030, is driven by significant advancements in computational power and data availability, which enable more sophisticated AI algorithms and models. Governments worldwide, particularly in regions like Asia Pacific, are heavily investing in AI research and development, fostering a supportive environment for innovation. Additionally, the rapid digital transformation across various industries—such as healthcare, finance, manufacturing, and retail—demands AI solutions to enhance efficiency, decision-making, and customer experiences. Moreover, the competitive advantage offered by AI in automating processes and personalizing services compels businesses to integrate AI technologies, accelerating market adoption.

Technology Roadmap of Artificial Intelligence Market

The Artificial Intelligence market report covers the technology roadmap, with insights into the short-term and long-term developments.

-

Short-term (1-5 Years):

- Widespread adoption of transformer architectures, particularly in NLP tasks, leads to significant performance improvements.

- Federated learning techniques are increasingly implemented to enable collaborative model training across decentralized data sources while maintaining data privacy.

- Self-supervised learning approaches gain traction for unsupervised pre-training of AI models, improving model generalization and robustness.

- AI models with meta-learning capabilities emerge, enabling rapid adaptation to new tasks and environments with minimal training data.

- AI applications in personalized healthcare expand, offering tailored diagnosis, treatment recommendations, and drug discovery.

-

Long-term (5+ years):

- Novel AI architectures integrating neuro-symbolic approaches, quantum computing, and biological-inspired models emerge, pushing AI capabilities beyond current boundaries.

- Advancements in explainable AI methods enhance model transparency and interpretability, fostering trust and accountability in AI decision-making.

- Hybrid AI systems combining symbolic reasoning with deep learning approaches are developed, offering robust and flexible AI solutions for complex tasks.

- Integration of AI with augmented reality (AR) and virtual reality (VR) technologies enables immersive and interactive AI experiences, revolutionizing human-computer interactions.

- AI integration in smart cities infrastructure optimizes urban planning, transportation systems, and resource management for sustainable and livable cities.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Rise of deep learning and machine learning technologies

The rise of deep learning and machine learning technologies is acting as a potent catalyst for the burgeoning growth of the AI market. These cutting-edge techniques have revolutionized the way computers can process and analyze vast amounts of data, enabling them to identify intricate patterns, make predictions, and even mimic human-like decision-making processes. The rapid advancements in deep learning algorithms, combined with the increasing computational power and availability of big data, have paved the way for more sophisticated AI applications across various industries. From image and speech recognition to natural language processing and predictive analytics, deep learning and machine learning are empowering AI systems to tackle complex tasks with unprecedented accuracy and efficiency, thereby driving widespread adoption and fueling the exponential expansion of the AI market.

Restraint: High costs associated with training data preparation

High initial investments and implementation costs pose a significant restraint for the AI market, deterring some organizations from fully embracing AI technologies. The upfront expenses associated with developing or procuring AI solutions, infrastructure setup, data collection, and talent acquisition can be substantial, particularly for small and medium-sized enterprises. Studies indicate that more than 50% of executives cited cost as the primary obstacle to AI implementation in their organizations. The complexity of AI integration is also evident in the time required for deployment, with estimates indicating that it takes an average of 18 months for companies to move from AI pilot projects to full-scale implementation. These financial and operational challenges can hinder widespread adoption of AI solutions, particularly among organizations with limited budgets or risk aversion, thereby constraining the overall growth potential of the AI market.

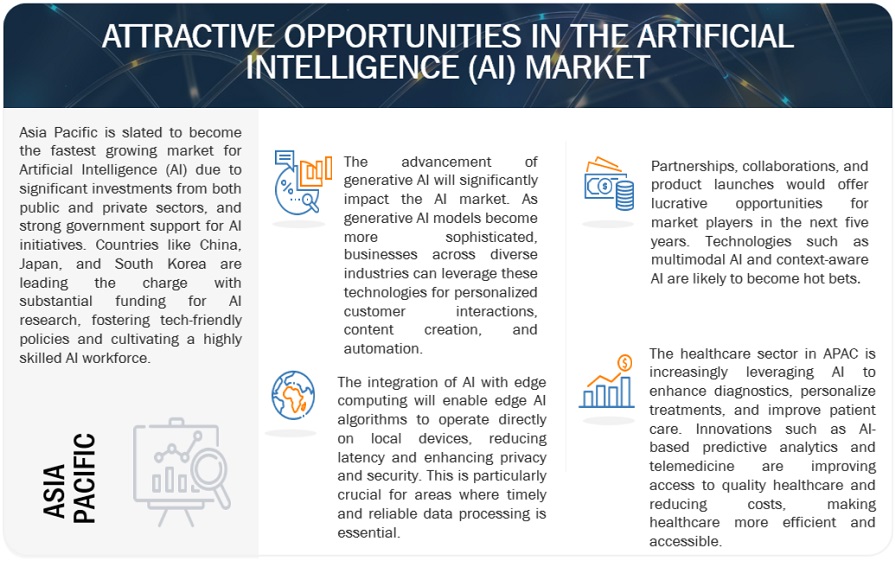

Opportunity: Advancements in generative AI to open new avenues for AI-powered content creation

Advancements in generative AI are opening new avenues for AI-powered content generation, presenting a significant opportunity for the AI market. Technologies such as GPT-4 and DALL-E are capable of creating high-quality text, images, and even videos, revolutionizing industries like marketing, entertainment, and content creation. Industry experts estimate that by 2025, 10% of all data produced will be generated by AI, a testament to the growing impact of generative AI technologies. These advancements enable businesses to produce personalized content at scale, enhancing customer engagement and reducing production costs. Enterprises are banking on the potential of generative AI to drive innovation and efficiency, creating new business models, and transforming industries through enhanced content creation capabilities.

Challenge:Concerns related to bias and inaccurately generated output

Concerns related to bias and inaccurately generated outputs pose a significant challenge for the AI market, as these issues can undermine the reliability and fairness of AI applications. Bias in AI systems can lead to discriminatory outcomes, which is a growing concern for both regulators and the public. Surverys have revealed that over 70% of CEOs are concerned about AI delivering biased outcomes, while 40% of consumers distrust AI due to perceived biases and inaccuracies. Inaccurately generated outputs, particularly from generative AI models, can spread misinformation and erode trust in AI technologies. Addressing these challenges is critical for the AI market's growth, requiring robust ethical standards, transparent algorithms, and ongoing efforts to mitigate biases.

Artificial Intelligence Market Ecosystem

By offering, software segment to account for the largest market share in 2024

Software segment is set to become the largest market segment in the AI market by revenue in 2024 due to its fundamental role in enabling diverse AI applications across industries. This segment includes both discriminative AI, which excels in tasks like classification and prediction, and generative AI, known for creating new content and simulating scenarios. These capabilities are crucial for industries such as finance, healthcare, and marketing, where AI-driven software solutions enhance efficiency, decision-making, and customer engagement. As companies seek to enhance efficiency, improve decision-making, and foster innovation, the demand for versatile and scalable AI software solutions is increasing. The flexibility of AI software to adapt to various use cases and industries positions it as a critical driver of AI adoption, underpinning the development and deployment of AI technologies on a wide scale.

By technology, context-aware AI is slated to register the highest growth rate during the forecast period.

Context-aware AI is expected to become the fastest growing market segment between 2024 and 2030 due to its capability to deliver highly personalized and adaptive user experiences by comprehending situational context. This advanced AI leverages data such as user behavior, environmental conditions, and temporal information to enhance the relevance and effectiveness of applications across various sectors. For instance, in healthcare, context-aware AI can improve patient monitoring and diagnostics by adapting to individual health patterns and environmental factors. In the automotive industry, it enhances safety and driving experience by responding to real-time road and driver conditions. According to a report by the World Economic Forum, 79% of executives believe that AI and machine learning will revolutionize their industries by 2025, with context-aware AI playing a pivotal role in this transformation. This growing recognition of the benefits of context-aware systems is driving accelerated investment and innovation, making it a key growth area in the AI market.

By business function, marketing & sales segment will hold the largest market share in 2024.

The marketing & sales business function is estimated to hold the largest market share in 2024 due to the significant impact AI technologies have on optimizing customer engagement, targeting, and conversion strategies. AI-powered tools such as predictive analytics, customer segmentation, and personalized recommendation systems enable businesses to understand and anticipate customer needs more accurately. This leads to more effective marketing campaigns, higher customer satisfaction, and increased sales. Additionally, AI-driven automation in customer service and sales processes enhances efficiency and reduces operational costs. As companies increasingly prioritize data-driven decision-making to stay competitive, the demand for AI solutions in marketing and sales is surging, driving substantial investment and revenue growth in this segment.

By vertical, healthcare & life sciences industry is set to witness the fastest growth rate over the forecast period.

The healthcare and life sciences industry is poised to become the fastest-growing market segment in the AI market during the forecast period due to several key factors. Firstly, the increasing adoption of electronic health records (EHRs) and the digitization of medical data have created vast repositories of information ripe for AI-driven analysis and insights. AI technologies, such as machine learning and natural language processing, can extract valuable insights from these data sets, enabling more accurate diagnoses, personalized treatments, and predictive healthcare analytics. Secondly, the growing demand for telemedicine and remote patient monitoring solutions, accelerated by the COVID-19 pandemic, is driving the need for AI-powered tools that can enhance virtual care delivery and improve patient outcomes. Additionally, the rising prevalence of chronic diseases and the aging population are fueling the demand for innovative healthcare solutions that can optimize resource allocation, streamline workflows, and improve operational efficiency.

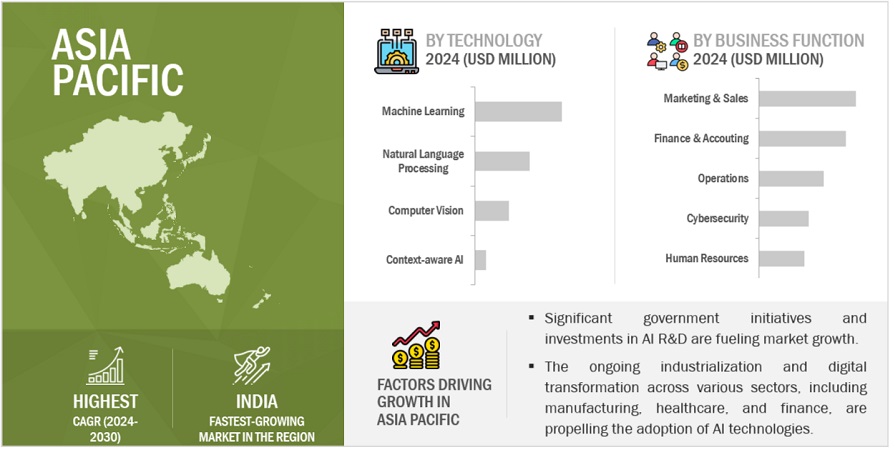

By region, Asia Pacific is set to experience the fastest growth rate during the forecast period.

Asia Pacific is set to emerge as the fastest-growing region in AI market, due to several key factors. Firstly, the region's robust economic growth, fueled by emerging markets such as China, India, and Southeast Asia, presents a fertile ground for AI adoption and investment. These countries are rapidly digitizing their economies and investing heavily in AI infrastructure to drive innovation and competitiveness across various sectors. For instance, in May 2023, the Chinese government unveiled plans to construct AI industrial hubs and tech platforms nationwide, with the aim of bolstering research and development efforts. Furthermore, on September 2022, the Shenzhen government passed China’s first local regulation exclusively dedicated to enhancing AI development. Known as the “Regulations on Promoting Artificial Intelligence Industry in Shenzhen Special Economic Zone” (the Shenzhen AI Regulation), this legislation aims to drive the growth of the AI industry by encouraging government organizations to embrace artificial intelligence technology as pioneers and by providing increased financial support for artificial intelligence research within China.

Furthermore, the generative AI boom is accelerating AI development and adoption in the APAC region. Japanese companies such as SoftBank and Hitachi are actively developing or integrating generative AI into their operations. In March 2023, Mitsui & Co., Ltd., one of Japan’s leading conglomerates, partnered with NVIDIA on an initiative called Tokyo-1. This collaboration aims to empower the nation’s pharmaceutical leaders through advanced technologies, including high-resolution molecular dynamics simulations and generative AI models for drug discovery. Also, according to the draft of the Integrated Innovation Strategy for 2023, the Japanese government is committed to promoting the adoption of generative AI and enhancing domestic capabilities for its development. Simultaneously, the government aims to address potential risks associated with generative AI, such as copyright infringement and the exposure of confidential information.

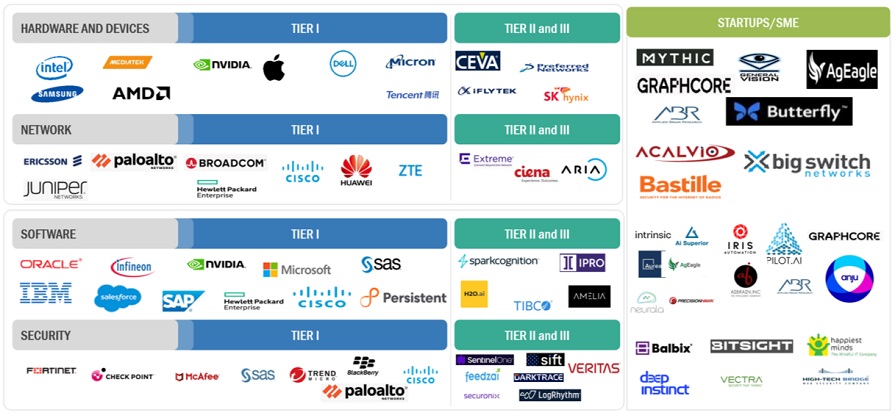

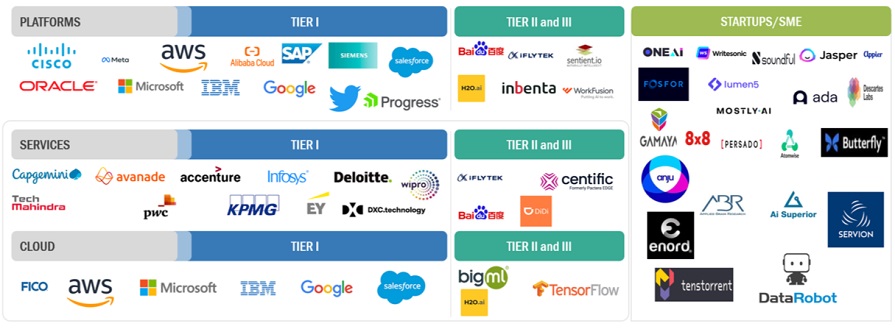

Key Market Players

The artificial intelligence solution and service providers have implemented several types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the artificial intelligence market include Microsoft (US), IBM (US), AWS (US), Google (US), Nvidia (US), along with SMEs and startups such as OpenAI (US), AI21 Labs (Israel), Mostly AI (Austria), Sentient.io (Canada) and Appier (Taiwan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2030 |

|

Forecast units |

USD (Billion) |

|

Segments Covered |

Offering, Technology, Business Function, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), NVIDIA (US), OpenAI (US), Oracle (US), Meta (US), Microsoft (US), Google (US), AWS (US), Intel (US), Salesforce (US), SAP (Germany), Cisco (US), HPE (US), Siemens (Germany), Baidu (China), SAS Institute (US), AMD (US), Qualcomm (US), Huawei (China), Alibaba Cloud (China), C3 AI (US), HQE Systems (US), Dialpad (US), Anduril Industries (US), Adept (US), DeepL (Germany), Moveworks (US), Arrow AI (US), Anthropic (US), Observe.ai (US), Anyscale (US), Frame AI (US), Uizard (Denmark), Shield AI (US), Cohere (Canada), Writesonic (US), Arthur (US), Capacity (US), Spot AI (US), Inbenta (US), Glean (US), Jasper (US), Atomwise (US), H2O.AI (US), Inflection AI (US), Persado (US), Appier (Taiwan), Graphcore (UK), AI21 Labs (Israel), Scale AI (US), IRIS Automation (US), Gamaya (Switzerland), Synthesia (England), Mostly AI (Austria), Mythic (US), Character.ai (US), ADA (Canada), Sentient.io (Singapore), Lumen5 (Canada), Aera Technology (US), Metropolis (US), Cerebras (US), Hailo (Israel), Soundful (US), and One AI (Israel). |

This research report categorizes the artificial intelligence market based on offering, technology, business function, vertical, and region:

By Offering:

-

Hardware

- AI Accelerators

-

Processors

- Central Processing Units (CPU)

- Graphics Processing Units (GPU)

- Field Programmable Gate Arrays (FPGA)

- Other Processors

- Memory

- Networking Hardware

-

Software

-

Software, By Type

-

Discriminative AI

- Classification Algorithms

- Regression Algorithms

- Deep Learning Platforms

- Ensemble Methods

-

Generative AI

- Generative Adversarial Networks (Gans)

- Autoencoders

- Convolutional Neural Networks (Cnns)

-

Transformer Models

- Bidirectional Encoder Representations From Transformers (BERT)

- Generative Pre-trained Transformer 1 (GPT-1)

- Generative Pre-trained Transformer 2 (GPT-2)

- Generative Pre-trained Transformer 3 (GPT-3)

- Generative Pre-trained Transformer 4 (GPT-4)

- Language Model for Dialogue Applications (LaMDA)

- Other Transformer Models

-

Discriminative AI

-

Software, By Deployment Mode

- Cloud

- On-Premises

-

Software, By Coding Automation

- No-code AI

- Low-code AI

- Pro-code AI

-

Software, By Type

-

Services

-

Professional Services

- Training & Consulting Services

- System Integration & Deployment Services

- Support & Maintenance Services

- Managed Services

-

Professional Services

By Technology

-

Machine Learning

- Supervised Learning

- Unsupervised Learning

- Reinforcement Learning

-

Natural Language Processing

-

Natural Language Understanding (NLU)

- Text Classification

- Named Entity Recognition (NER)

- Intent Recognition

- Relationship Extraction

- Others

-

Natural Language Generation (NLG)

- Text Summarization

- Machine Translation

- Language Modelling

- Dialogue Generation

-

Natural Language Understanding (NLU)

-

Computer Vision

- Object Detection

- Image Classification

- Semantic Segmentation

- Facial Recognition

- Others

-

Context-aware Artificial Intelligence (CAAI)

- Context-Aware Recommendation Systems

- Multi-Modal AI

- Context-Aware Virtual Assistants

By Business Function:

-

Marketing & Sales

- Customer Segmentation

- Predictive Lead Scoring

- Personalized Recommendations

- Dynamic Pricing Optimization

- Churn Prediction

- Sentiment Analysis

- Marketing Attribution

- Others

-

Human Resources

- Candidate Screening

- Employee Retention Analysis

- Performance Management

- Workforce Planning & Forecasting

- Employee Feedback Analysis

- Skill Gap Analysis

- Diversity & Inclusion Analytics

- Others

-

Finance & Accounting

- Fraud Detection

- Financial Forecasting

- Expense Management

- Invoice Processing

- Credit Risk Assessment

- Regulatory Compliance

- Budgeting And Planning

- Others

-

Operations

- Predictive Maintenance

- Supply Chain Optimization

- AIOps

- IT Service Management

- Quality Control

- Route Optimization

- Cold Chain Monitoring

- Inventory Management

- Procurement Automation

- Equipment Failure Prediction

- Others

-

Cybersecurity

- Threat Detection & Response

- Anomaly Detection

- Vulnerability Assessment

- Identity & Access Management

- Security Automation & Orchestration

- Endpoint Protection

- Network Traffic Analysis

- Others

By Vertical:

-

BFSI

- Fraud Detection & Prevention

- Risk Assessment & Management

- Algorithmic Trading

- Credit Scoring & Underwriting

- Customer Service Automation

- Personalized Financial Recommendations

- Investment Portfolio Management

- Regulatory Compliance Monitoring

- Others

-

Retail & E-Commerce

- Personalized Product Recommendation

- Customer Relationship Management

- Visual Search

- Virtual Customer Assistant

- Price Optimization

- Supply Chain Management & Demand Planning

- Virtual Stores

- Others

-

Automotive, Transportation & Logistics

- Semi-Autonomous & Autonomous Vehicles

- Route Optimization

- Intelligent Traffic Management

- Driver Assistance Systems

- Smart Logistics & Warehousing

- Supply Chain Visibility & Tracking

- Fleet Management

- Vehicle Diagnostics & Telematics

- Others

-

Government & Defense

- Surveillance & Situational Awareness

- Law Enforcement

- Intelligence Analysis & Data Processing

- Simulation & Training

- Command & Control

- Disaster Response & Recovery Assistance

- E-Governance & Digital City Services

- Others

-

Healthcare & Life Sciences

- Patient Data & Risk Analysis

- Lifestyle Management & Monitoring

- Precision Medicine

- Inpatient Care & Hospital Management

- Medical Imaging & Diagnostics

- Drug Discovery

- AI-Assisted Medical Services

- Medical Research

- Others

-

Telecommunications

- Network Optimization

- Network Security

- Customer Service & Support

- Network Planning & Optimization

- Network Analytics

- Intelligent Call Routing

- Network Fault Prediction

- Virtual Network Assistants

- Voice & Speech Recognition

- Others

-

Energy & Utilities

- Energy Demand Forecasting

- Grid Optimization & Management

- Energy Consumption Analytics

- Smart Metering & Energy Data Management

- Energy Storage Optimization

- Real-Time Energy Monitoring & Control

- Power Quality Monitoring & Management

- Energy Trading & Market Forecasting

- Intelligent Energy Management Systems

- Others

-

Manufacturing

- Material Movement Management

- Predictive Maintenance & Machinery Inspection

- Production Planning

- Recyclable Material Reclamation

- Quality Control

- Production Line Optimization

- Intelligent Inventory Management

- Others

-

Agriculture

- Crop Monitoring & Yield Prediction

- Precision Farming

- Soil Analysis & Nutrient Management

- Pest & Disease Detection

- Irrigation Optimization & Water Management

- Automated Harvesting & Sorting

- Weed Detection & Management

- Weather & Climate Monitoring

- Livestock Monitoring & Health Management

- Others

-

IT/ITeS

- Automated Code Generation & Optimization

- Automated IT Asset Management

- IT Ticketing & Support Automation

- Intelligent Data Backup & Recovery

- Automated Software Testing & Quality Assurance

- Others

-

Media & Entertainment

- Content Recommendation Systems

- Content Creation & Generation

- Content Copyright Protection

- Audience Analytics & Segmentation

- Personalized Advertising

- Others

- Other Verticals

By Region

-

North America

- United States

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic

- Benelux

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia and New Zealand (ANZ)

- ASEAN

- Rest of Asia Pacific

-

Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Qatar

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Recent Developments:

- In April 2024, Intel launched the Gaudi 3 accelerator, designed to advance AI performance and scalability. The Gaudi 3 features enhanced networking capabilities with 200 Gbps Ethernet connections, allowing it to scale up to clusters of 8,192 accelerators. This accelerator aims to boost Intel's AI strategy by providing robust solutions for training and inference workloads, achieving up to 1.7 times faster training speeds compared to competitive models?.

- In April 2024, Informatica joined hands with Google to develop an MDM Extension for Google Cloud BigQuery, facilitating rapid access to trusted customer data. The collaboration enables enterprise-grade GenAI applications leveraging IDMC, Google Vertex AI, BigQuery, and Gemini models for enhanced analytics and insights.

- In April 2024, Samsung struck a deal worth USD 3 billion with AMD to supply HBM3E memory chips for AMD’s AI chips, enhancing their performance. Samsung's chips, known for high bandwidth and capacity, will power AMD's MI350, competing with NVIDIA's offerings.

- In April 2024, Qualcomm introduced the Snapdragon X Plus, featuring the Qualcomm Oryon CPU for a reported 37% boost in CPU performance and 54% less power consumption. The CPU is tailor made for AI-driven applications with the Hexagon NPU, offering 45 TOPS for laptops, aiming to revolutionize mobile computing.

- In April 2024, Microsoft and The Coca-Cola Company entered a five-year strategic partnership to advance Coca-Cola's technology strategy, leveraging Microsoft Cloud and generative AI. The USD 1.1 billion commitment aims to drive innovation and productivity across Coca-Cola’s global operations.

- In April 2024, Arena and AMD collaborated to deploy Arena Atlas, an AI test & optimization product, enhancing GPU testing and optimization. Atlas autonomously identifies power and performance optimizations, accelerating product development and improving chip design.

- In March 2024, Salesforce launched the Einstein 1 Studio platform. Einstein 1 Studio empowers admins and developers with low-code AI tools to customize Einstein Copilot and embed AI across Salesforce apps. Deep integration with Salesforce Data Cloud also ensures rich insights leveraged from customer data.

- In March 2024, NVIDIA join forces with Microsoft to revolutionize healthcare and life sciences with cloud, AI, and accelerated computing. Leveraging Azure and NVIDIA technologies, the collaboration aims to accelerate drug discovery, enhance medical imaging diagnostics, and advance genomics analysis for improved patient care worldwide.

- In March 2024, IBM and Riyadh Air collaborated to transform air travel experiences, leveraging AI for augmenting customer experience throughout the travel. Riyadh Air aims to offer seamless, personalized journeys, utilizing IBM Consulting's expertise across channels and IBM Garage's collaborative model.

- In February 2024, OpenAI announced the introduction of Sora, a text-to-video generative AI model. Sora can generate videos for up to a minute long while maintaining visual quality and adherence to the user’s prompt. This model is not publicly available as of now and limited access has been granted to handful of red teamers, visual artists, designers, and filmmakers.

Frequently Asked Questions (FAQ):

What is Artificial Intelligence (AI)?

Artificial Intelligence (AI) refers to algorithms and computational models that enable machines to perform cognitive functions typically associated with human intelligence. These functions include, but are not limited to, natural language processing (NLP), machine learning (ML), computer vision, and decision-making. AI systems leverage advanced techniques such as deep learning, reinforcement learning, and probabilistic reasoning to process data, recognize patterns, and make autonomous decisions or provide predictive analytics. These systems are designed to improve over time through iterative training and adaptation, often utilizing large-scale data and high-performance computing infrastructure to optimize performance and accuracy.

What is the total CAGR expected to be recorded for the Artificial Intelligence market during 2024-2030?

The Artificial Intelligence market is expected to record a CAGR of 35.7% from 2024-2030.

How is the generative AI market shaping the broader artificial intelligence industry?

The generative AI market is profoundly shaping the broader artificial intelligence industry by driving advancements in machine learning, natural language processing, and creative applications. Technologies like OpenAI's recent GPT-4o have demonstrated significant progress, capable of producing coherent and contextually relevant text, which has spurred innovation across various sectors. The increasing capability and application of generative AI highlight its role as a catalyst for broader AI adoption, pushing the boundaries of what machines can autonomously create and enabling new business models and efficiencies across industries.

Which are the key drivers supporting the growth of the artificial intelligence market?

The key factors driving the growth of the artificial intelligence market include growth in adoption of autonomous artificial intelligence, rise of deep learning and machine learning technologies, and advancements in computing power and the availability of large databases.

Which are the top 3 verticals prevailing in the artificial intelligence market?

BFSI, healthcare & life sciences, and retail & eCommerce are the top three verticals in the AI market due to their vast data generation and the critical need for advanced analytics. BFSI utilizes AI for fraud detection, customer service, and risk management. Healthcare leverages AI for diagnostics, personalized treatment plans, and administrative efficiency. Retail benefits from AI through personalized marketing, inventory management, and customer insights, driving significant investments and innovations in these sectors.

Who are the key vendors in the artificial intelligence market?

Some major players in the AI market include IBM (US), NVIDIA (US), OpenAI (US), Oracle (US), Meta (US), Microsoft (US), Google (US), AWS (US), Intel (US), Salesforce (US), SAP (Germany), Cisco (US), HPE (US), Siemens (Germany), Baidu (China), SAS Institute (US), AMD (US), Qualcomm (US), Huawei (China), Alibaba Cloud (China), C3 AI (US), HQE Systems (US), Dialpad (US), Anduril Industries (US), Adept (US), DeepL (Germany), Moveworks (US), Arrow AI (US), Anthropic (US), Observe.ai (US), Anyscale (US), Frame AI (US), Uizard (Denmark), Shield AI (US), Cohere (Canada), Writesonic (US), Arthur (US), Capacity (US), Spot AI (US), Inbenta (US), Glean (US), Jasper (US), Atomwise (US), H2O.AI (US), Inflection AI (US), Persado (US), Appier (Taiwan), Graphcore (UK), AI21 Labs (Israel), Scale AI (US), IRIS Automation (US), Gamaya (Switzerland), Synthesia (England), Mostly AI (Austria), Mythic (US), Character.ai (US), ADA (Canada), Sentient.io (Singapore), Lumen5 (Canada), Aera Technology (US), Metropolis (US), Cerebras (US), Hailo (Israel), Soundful (US), and One AI (Israel). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

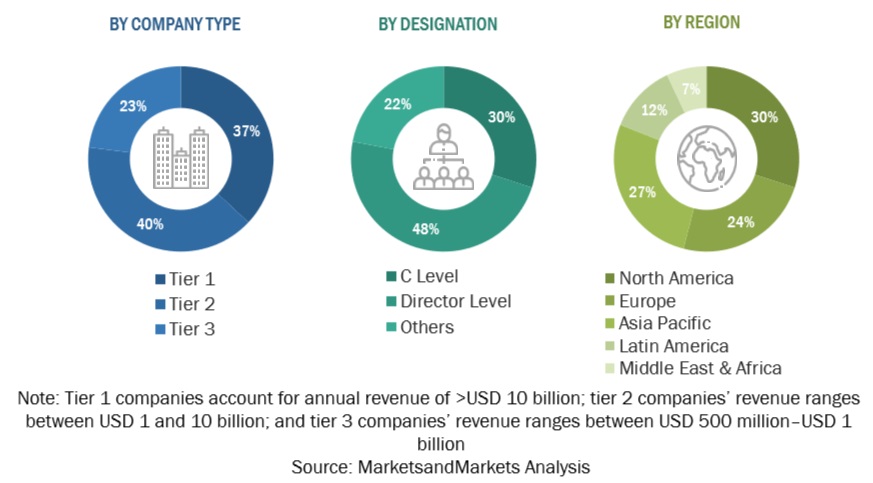

The Artificial Intelligence (AI) market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred artificial intelligence providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, artificial intelligence spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to software, hardware, services, deployment mode, technology, business function, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and artificial intelligence expertise; related key executives from artificial intelligence solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using artificial intelligence solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of artificial intelligence solutions and services, which would impact the overall artificial intelligence market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

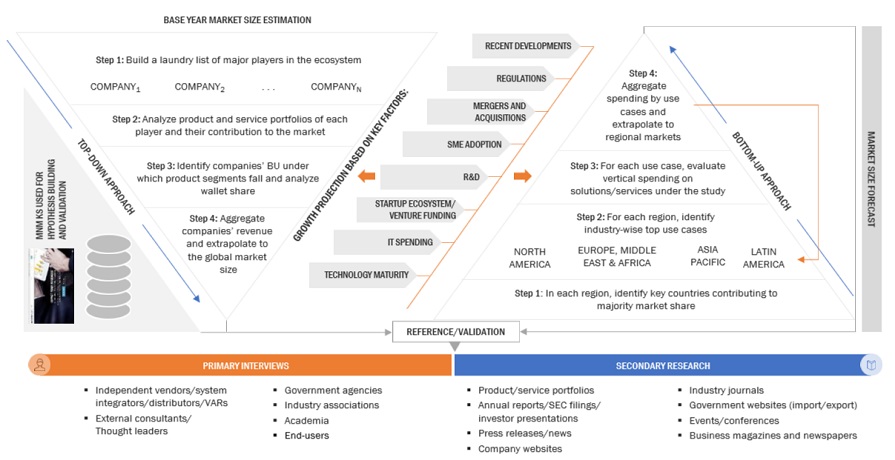

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the artificial intelligence market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the artificial intelligence market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on breadth of hardware, software and services according to technologies, business functions, deployment modes, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of artificial intelligence solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of artificial intelligences solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the artificial intelligence market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major artificial intelligences providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall artificial intelligence market size and segments’ size were determined and confirmed using the study.

Global Artificial Intelligence Market Size: Bottom-Up and Top-Down Approach:

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Artificial Intelligence (AI) refers to algorithms and computational models that enable machines to perform cognitive functions typically associated with human intelligence. These functions include, but are not limited to, natural language processing (NLP), machine learning (ML), computer vision, and decision-making. AI systems leverage advanced techniques such as deep learning, reinforcement learning, and probabilistic reasoning to process data, recognize patterns, and make autonomous decisions or provide predictive analytics. These systems are designed to improve over time through iterative training and adaptation, often utilizing large-scale data and high-performance computing infrastructure to optimize performance and accuracy.

Stakeholders

- Artificial intelligence software developers

- Artificial intelligence hardware vendors

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end-users

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Managed service providers

- Market research and consulting firms

- Support & maintenance service providers

- System Integrators (SIs)/migration service providers

- Technology providers

Report Objectives

- To define, describe, and predict the artificial intelligence market by offering (hardware, software and services), technology, business function, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the artificial intelligence market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the artificial intelligence market

- To analyze the impact of recession across all the regions across the artificial intelligence market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American artificial intelligence market

- Further breakup of the European artificial intelligence market

- Further breakup of the Asia Pacific artificial intelligence market

- Further breakup of the Middle Eastern & African artificial intelligence market

- Further breakup of the Latin America artificial intelligence market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence (AI) Market